Demand for foodstuff in Africa to grow due to rapid urbanisation

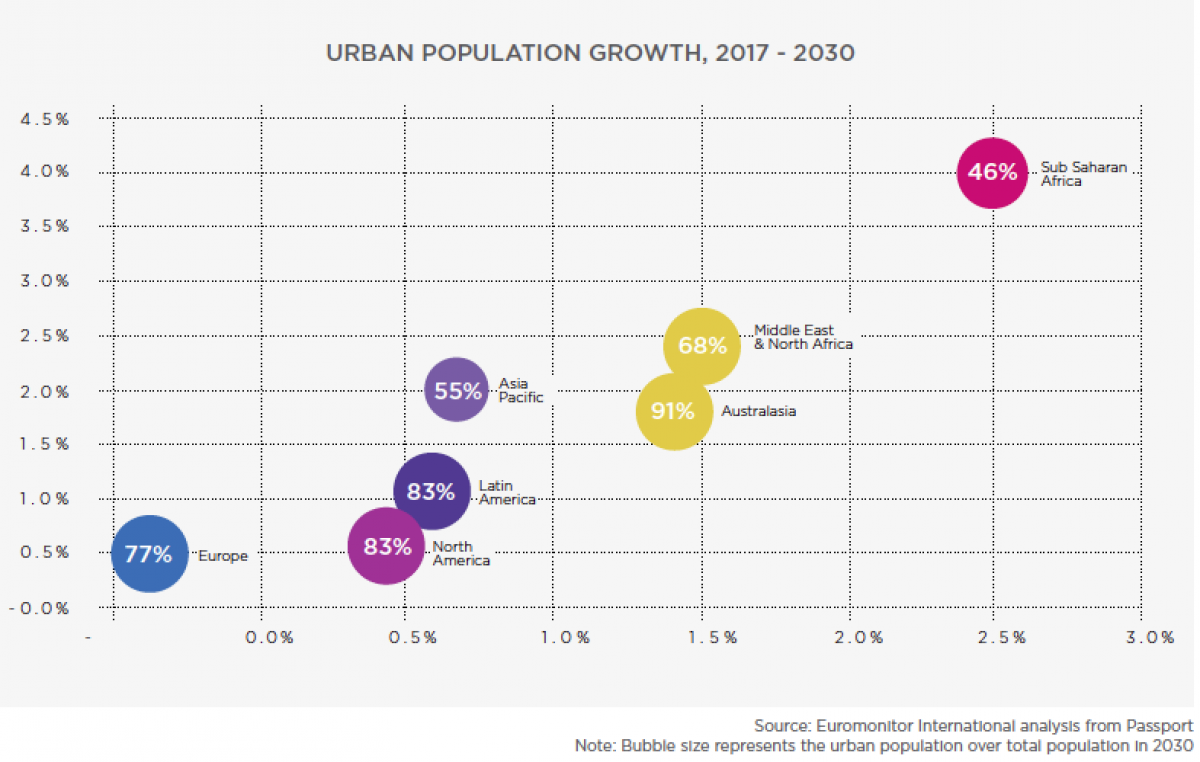

Featured , Foodstuff , Industry ReportsBy 2030, 60% of the total world population will be living in urban areas. Urbanisation offers a dense, concentrated market and opportunities for retail infrastructure and products tailored to newly affluent consumers as well as large sections of the community on low incomes. Growth in urbanisation is expected to surpass overall population growth in all regions.

High urbanisation growth, as demonstrated in Sub-Saharan Africa, offers potential as new cities coalesce around natural growth in the population, migration from rural areas and reclassification/upgrading of former slums into urban areas. Urbanisation growth in the Middle East & North Africa region is also expected to be strongly influenced by large-scale infrastructure development, agricultural and land reform and the development of older and new cities.

Growing urbanisation in these regions influences demand for food and beverage categories differently. Demand for higher-priced convenience categories such as RTD tea and coffee and higher-grade olive oils is greater in the Middle East and North Africa due to higher disposable income levels while more mass market products, such as beverages (bottled water, packaged tea) and dairy products are in greater demand in Sub-Saharan Africa.

In Nigeria, staple foods, such as a rice, pasta and noodles, have seen strong growth

In Nigeria, urban population has been price sensitive due to economic uncertainty which has forced unit prices for food and beverages to rise strongly in recent years. Staple foods, such as a rice, pasta and noodles, have seen strong growth. Instant noodles, for example, are increasingly popular and are seen as convenient to prepare, fairly cheap, and widely available. Dufil Prima Foods’ Indomie noodles brand is now a market leader as a result of good incentives for distributors, strong below-the-line advertising, frequent consumer promotions, as well as the availability of a variety of pack sizes and flavours.

In Manila, one of the most densely populated cities in the world, the importance of product convenience has been prominent to address the demand of the urban population. Companies such as AB Nutribev have found success with their Vitamilk product, available in 300ml glass bottles and positioned as a healthy energy drink that can help address hunger and tiredness. It targets the increasing demand for on-the-go consumption. In 2017, Purefoods-Hormel Co started construction of new production facilities for hotdogs, chicken nuggets, corned beef and luncheon meat in the Philippines to meet demand in the mid-to-high end of the market. Modern retailing in the Philippines is expanding more rapidly than traditional grocery retailing, offering greater opportunities for hot and chilled foods.

Highly urbanised societies in Europe create a different profile of product demand. Meat substitutes and hot cereals are examples of key growth categories on the back of strong health and wellness concerns. For example, in the mature and saturated processed meat market in Germany, meat substitutes are now a small but strongly performing category. Meat consumption is changing with a growing number of vegetarians and those following a vegan lifestyle. In addition, many consumers aim to lower their meat consumption as part of a healthy heart lifestyle.

This emerging consumer group presents significant opportunities for growth with many meat processors now venturing into this category to ensure full portfolio coverage within this market. Pure discounter Aldi offers a wide range of vegan options including burgers, schnitzel, meatless hotdogs, meatless meatballs, chickenless nuggets and meat-free mince and in December 2017, it launched its range in an additional 17 countries.